Real Estate Investments Los Angeles Armour Real Estate Investment Trust

top

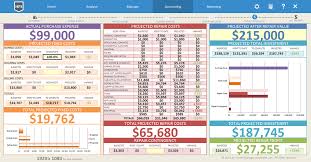

We are the complete source for total info and resources for House Flipping Spreadsheet online.

Unless you have enough cash to pay for a residence and also all required improvements, you'll need some kind of loan.And financing requirements are tighter than they made use of to be, particularly if you desire a finance for a risky home flip.Your very first step is to inspect your credit rating record to figure out your score.Federal regulation permits you a totally free credit report from each of the three nationwide credit scores reporting companies every twelve month, so this won't cost you anything.

You can get your cost-free credit record from AnnualCreditReport.com or by calling 1-877-322-8228. If you do not have great credit rating, it's time to begin constructing a good credit score now.Pay your costs in a timely manner, pay for your financial debt, and also keep your credit card balances low.

There are plenty of other ways to boost your credit rating, so take the time to do every little thing you can.

The higher your credit rating, the much better interest rate you'll jump on a mortgage.

This can save you thousands when you begin house turning, maximizing even more of your cash to purchase your house itself.Last, make sure you know what hurts your credit report.

As an example, taking out way too many bank card simultaneously lowers your score.You do not want to do anything to injure your score in the months before you request a finance.

lenty of Cash money If you want to flip a home, you need cash.New investors enter monetary problem when they get a home without a substantial down payment, then make use of charge card to pay for home improvements and also renovations.If your home does not market quickly, or if remodellings set you back greater than anticipated, suddenly the financier is in way over their head.

If you want to turn effectively, you require lots of cash accessible. Many standard lenders need a deposit of 25%, as well as typical lenders are where you'll obtain the most effective price.

When you have the cash to cover a down payment, you do not need to pay personal mortgage insurance policy, or PMI.5% as well as 5% of the loan, so having to pay this every month can actually cut into your profits.According to TIME, the majority of capitalists get an interest-only car loan, as well as the ordinary interest rate for this type of loan is 12% to 14%. In contrast, the rate of interest for a standard home mortgage is normally 4%. The more you can pay in money, the much less rate of interest you'll sustain.

There are a number of means to develop money in your interest-bearing account. Utilize an automated savings intend to make saving loan monthly effortless.Or discover means to earn extra money on the side and then utilize this money to develop your money reserves for an investment.If you're purchasing a repossession from a financial institution or through a realty public auction, one more alternative is to obtain a house equity line of credit (HELOC), if you qualify.If you have sufficient in financial savings as well as take care of to discover a bargain-priced home, you can get the house and afterwards get a tiny lending or credit line to spend for the improvements and various other prices.

Just because a residence is costing a rock-bottom price does not mean you can place cash in it and immediately make a fortune.Successful flippers are very critical concerning the houses they choose to buy.

It can take months to find and buy the right property. That's because each day that passes costs you more money (mortgage, utilities, property taxes, insurance, etc.). Learn How Much Average Projects Cost Do you know how much it costs to recarpet a 1,000-square-foot home? This can save you thousands when you start house flipping, freeing up more of your money to invest in the house itself. Understand Your Finance Options Next, become an expert on home financing options.

More Details Around House Flipping Spreadsheet

Below are Some Even more Information on House Flipping Spreadsheet

Once the work is done, you'll need to schedule inspections to make sure the property complies with applicable building codes before you can sell it. You can sneak by the competition by targeting a neighborhood and going door-to-door making offers. Some of the most popular include: You can also find foreclosure listings through real estate company websites like Re/Max. Novices rush out to buy the first house that they see.

More Information Around House Flipping Spreadsheet

Not Enough Knowledge To be successful, you need to be able to pick the right property, in the right location, at the right price. Let’s say a home’s ARV (or value after necessary repairs) is $200,000, and it needs $30,000 in repairs.

A lot more Resources For House Flipping Spreadsheet Right here are Some Even more Resources on House Flipping Spreadsheet

When you run a report on BuildFax, you learn the furnace is closer to 20 years old. In comparison, the interest rate for a conventional home loan is typically 4%. We don't want you to waste your reserve funds paying for house flipping classes or courses when we've laid out all the information you need to be successful right here in Flipping Houses 101. You now have to pay for your own rent or mortgage, plus the mortgage for your flip property, as well as utilities, home insurance, and property taxes. When you buy a home to flip, it’s important not to over-value the home by investing too much in renovation. Put simply, don't pay too much for a home (by knowing what it's worth) and make sure you also know how much the necessary repairs or upgrades will cost before you buy. 16 Answers · Business & Finance · 02/09/2006 Flipping houses? ...get anything and they get to walk away woth...just take over the house payment with the bank and flip the house this way...competition. Contractors who are habitually late will waste your time and slow up your renovation project. Having that information, you can then figure an ideal purchase price. For example, taking out too many credit cards at once lowers your score.

Previous >>>

More Info

Union Investment Real Estate Colombia Real Estate Investment

Real Estate Investments Los Angeles Best Real Estate Investment In Hyderabad 2016

Self Directed Ira Real Estate Investment Investing In Real Estate With Self Directed Ira