Real Estate Investments Los Angeles Investment Real Estate Naics Code

index

We have the top source for complete information and resources for Flipping Houses 101 online.

Unless you have enough cash to pay for a residence and all necessary restorations, you'll require some sort of loan.And lending requirements are tighter than they utilized to be, particularly if you want a lending for a high-risk residence flip.Your primary step is to inspect your credit score record to discover your score.Federal legislation permits you a complimentary credit scores report from each of the three national credit reporting business every 12 months, so this will not cost you anything.

You can get your complimentary debt record from AnnualCreditReport.com or by calling 1-877-322-8228. If you do not have fantastic credit rating, it's time to start constructing a great credit rating now.Pay your expenses on time, pay for your financial debt, as well as maintain your credit card balances reduced.

There are plenty of other ways to improve your credit score, so put in the time to do everything you can.

The greater your credit history, the much better rates of interest you'll hop on a home loan.

This can save you thousands when you begin house flipping, freeing up more of your loan to buy your house itself.Last, make certain you recognize what harms your credit history.

As an example, getting way too many charge card at the same time reduces your score.You don't wish to do anything to hurt your rating in the months before you obtain a finance.

lenty of Cash If you intend to turn a residence, you require cash.New capitalists enter monetary difficulty when they acquire a residence without a sizable down payment, then utilize bank card to pay for residence improvements and also renovations.If your home doesn't sell quickly, or if renovations cost more than expected, suddenly the financier remains in way over their head.

If you intend to flip effectively, you require a lot of cash money accessible. Most traditional loan providers require a down payment of 25%, and traditional loan providers are where you'll get the most effective rate.

When you have the cash to cover a deposit, you do not need to pay exclusive home loan insurance policy, or PMI.5% as well as 5% of the finance, so needing to pay this each month can really reduce into your profits.According to TIME, many financiers secure an interest-only car loan, as well as the ordinary rate of interest for this sort of funding is 12% to 14%. In contrast, the interest rate for a traditional home mortgage is generally 4%. The more you can pay in cash money, the less rate of interest you'll incur.

There are several methods to construct cash in your savings account. Utilize an automatic savings prepare to make conserving cash each month effortless.Or discover means to earn additional money on the side and after that use this money to construct your money gets for an investment.If you're acquiring a repossession from a bank or via a realty public auction, another choice is to secure a residence equity line of credit (HELOC), if you qualify.If you have enough in cost savings and also take care of to locate a bargain-priced home, you can purchase the residence and afterwards obtain a little funding or line of credit to spend for the improvements and also various other prices.

Even if a home is selling for a low price does not indicate you can place money in it as well as instantly make a fortune.Successful flippers are extremely discerning concerning the houses they pick to purchase.

Find a Mentor If you know a successful house flipper, ask if they’d be willing to mentor you. Novices rush out to buy the first house that they see. That profit is typically derived from price appreciation resulting from a hot real estate market in which prices are rising rapidly or from capital improvements made to the property – or both. The higher your credit score, the better interest rate you’ll get on a home loan.

Right here are Some Even more Information on Flipping Houses 101

Even more Information About Flipping Houses 101

If memory serves me properly, this property needed basement foundation repairs, a full kitchen renovation, a new basement interior, two new bathrooms, new floors and landscaping. And lending standards are tighter than they used to be, especially if you want a loan for a high-risk house flip. Far too many would-be real estate moguls overlook the basics and end up failing. If the house doesn’t sell quickly, or if renovations cost more than expected, suddenly the investor is in way over their head. The first, best piece of advice is to limit your financial risk and also maximize your return potential. This means inventory is so low and demand is so high that flippers are paying above-market prices for homes, which can drastically reduce net profit.

More Details About Flipping Houses 101

It can take months to find and buy the right property. Do whatever you can to build relationships with future buyers. Great Location Expert house flippers can’t stress this enough. House Flipping Requirements If you’re still reading, it means you’re relatively unfazed by the high risks of house flipping. That’s more than many people make in a year, and it lures plenty of newcomers who dream of quitting their day jobs and becoming full-time investors.

Extra Resources For Flipping Houses 101 Right here are Some More Resources on Flipping Houses 101

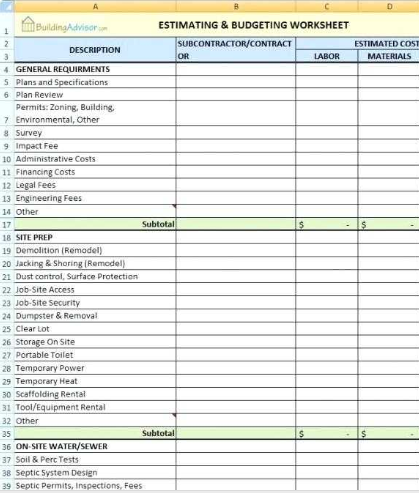

An easy way to research financing costs is by using a mortgage calculator. It can take months to find and buy the right property. Great Credit You can’t get into house flipping with lousy credit, end of story. A general contractor, or GC, is a building professional who manages the whole renovation project and hires their own subcontractors to do the necessary work. For $39, BuildFax provides a comprehensive background check on a home. If you want to flip successfully, you need plenty of cash on hand. Most traditional lenders require a down payment of 25%, and traditional lenders are where you’ll get the best rate. 5% and 5% of the loan, so having to pay this each month can really cut into your profits. The market is far too efficient for that to occur on a frequent basis. It taught us what to buy, when to buy, how to best sell, how to deal with Realtors, what upgrades are important and which aren’t necessary. The show made it look simple: find a cheap home for sale, put some money and sweat equity into fixing it up, then resell it for a huge profit. In a neighborhood of $100,000 homes, do you really expect to buy at $60,000 and sell at $200,000? In a neighborhood of $100,000 homes, do you really expect to buy at $60,000 and sell at $200,000? The show made it look simple: find a cheap home for sale, put some money and sweat equity into fixing it up, then resell it for a huge profit. Toss in an unexpected structural problem with the property and a gross profit can become a net loss. Again, if they have a problem with time management, it will affect your renovation.

Last Post Next one

More Info

Union Investment Real Estate Real Estate Investing In Canada Pdf

Union Investment Real Estate How To Start Investing In Multifamily Real Estate

Long Distance Real Estate Investing Pdf How To Invest 5000 In Real Estate