Real Estate Investments Los Angeles Passive Income Real Estate Investing

index

We have the complete source for total information and resources for Flip This House on the Internet.

Unless you have enough cash to spend for a home as well as all necessary renovations, you'll require some sort of loan.And borrowing requirements are tighter than they utilized to be, especially if you desire a lending for a high-risk house flip.Your very first step is to inspect your credit record to find out your score.Federal regulation allows you a complimentary credit scores report from each of the 3 nationwide credit scores reporting companies every twelve month, so this will not cost you anything.

You can obtain your free credit score report from AnnualCreditReport.com or by calling 1-877-322-8228. If you don't have wonderful debt, it's time to begin constructing an excellent credit score now.Pay your bills on time, pay for your financial debt, as well as maintain your bank card balances reduced.

There are plenty of other methods to enhance your credit rating, so make the effort to do everything you can.

The higher your credit rating, the better interest rate you'll hop on a home loan.

This can conserve you thousands when you begin residence flipping, freeing up more of your loan to purchase your home itself.Last, ensure you recognize what hurts your credit report.

For instance, getting a lot of bank card at once reduces your score.You do not want to do anything to injure your rating in the months prior to you request a car loan.

lenty of Money If you wish to turn a home, you require cash.New financiers enter into economic problem when they buy a home without a large deposit, after that utilize credit cards to pay for residence improvements and also renovations.If your house does not sell quickly, or if improvements cost more than expected, all of a sudden the capitalist is in means over their head.

If you intend to flip successfully, you require a lot of cash on hand. Most typical loan providers require a deposit of 25%, and traditional loan providers are where you'll get the most effective rate.

When you have the cash money to cover a down payment, you don't need to pay personal home mortgage insurance coverage, or PMI.5% and also 5% of the funding, so having to pay this each month can really reduce into your profits.According to TIME, many investors get an interest-only finance, and also the ordinary rate of interest for this kind of loan is 12% to 14%. In contrast, the interest rate for a standard mortgage is commonly 4%. The even more you can pay in cash, the less passion you'll sustain.

There are a number of means to construct cash in your savings account. Make use of an automatic savings intend to make conserving loan every month effortless.Or find means to earn additional money on the side and after that use this loan to build your cash reserves for an investment.If you're buying a foreclosure from a bank or via a real estate public auction, an additional option is to obtain a residence equity credit line (HELOC), if you qualify.If you have enough in financial savings as well as handle to find a bargain-priced house, you can acquire the home and then take out a tiny financing or credit line to pay for the improvements and various other prices.

Just because a house is selling for a low rate does not suggest you can place cash in it as well as automatically make a fortune.Successful fins are very discerning about the homes they select to buy.

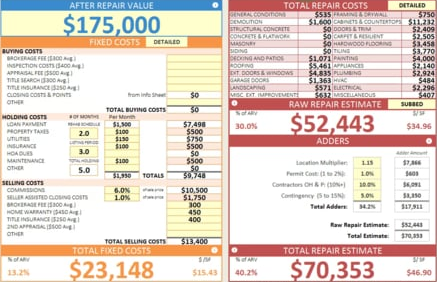

But the longer your home is tied up in projects, the less profit you stand to make; that’s why it’s so important to carefully weigh whether you should do the work yourself or hire help. The 70% rule states that an investor should pay no more than 70% of the ARV (after-repair value) of a property minus the repairs needed. The ARV is what a home is worth after it is fully repaired. Make sure you understand the ins and outs of home financing before you apply for a loan or make an offer on a house.

Here are Some More Information on Flip This House

Extra Resources For Flip This House Below are Some Even more Resources on Flip This House

That’s a quick turnaround time, and for your first few flips, it might be out of reach. Many investors attempt to generate a steady flow of income by engaging in frequent flips.

Even more Details About Flip This House

She laughed and shook her head. “We make it look easy,” she said. “But it’s risky, backbreaking work. I would personally suggest a...of studying & getting all your ...

Even more Details About Flip This House

This will allow you to make the best decision for your circumstances. And even if you get every detail right, changing market conditions could mean that every assumption you made at the beginning will be invalid by the end. Take it lightly at your peril: If you're just looking to get rich quick by flipping a home, you could end up in the poorhouse.All in all a person has to have some sort of cash on hand to even be able to start the process, and of course you have to know what you're doing at all times. The real money in house flipping comes from sweat equity. The real money in house flipping comes from sweat equity. Knowing when to DIY and when to hire a contractor is crucial. That’s more than many people make in a year, and it lures plenty of newcomers who dream of quitting their day jobs and becoming full-time investors. We don't want you to waste your reserve funds paying for house flipping classes or courses when we've laid out all the information you need to be successful right here in Flipping Houses 101.

<<< Next

More Info

Real Estate Investments Los Angeles Real Estate Investment Trust Risks

Self Directed Ira Real Estate Investment Best Countries To Invest In Real Estate 2019

Long Distance Real Estate Investing Pdf Real Estate Investment Analyst Job In Houston