Self Directed Ira Real Estate Investment Earn While You Learn Real Estate Investing

top

You found the best source for complete info and resources for Flipping Houses In Houston online.

Unless you have sufficient cash to pay for a residence as well as all essential improvements, you'll require some type of loan.And financing criteria are tighter than they used to be, especially if you want a finance for a high-risk home flip.Your initial step is to examine your debt record to discover your score.Federal regulation permits you a totally free credit record from each of the 3 nationwide credit report reporting companies every year, so this won't cost you anything.

You can get your complimentary debt record from AnnualCreditReport.com or by calling 1-877-322-8228. If you do not have terrific credit, it's time to begin developing an excellent credit rating now.Pay your bills on schedule, pay for your debt, as well as keep your bank card balances low.

There are lots of other means to improve your credit rating, so take the time to do whatever you can.

The greater your credit rating, the much better rates of interest you'll hop on a home loan.

This can save you thousands when you begin home flipping, maximizing even more of your money to buy the house itself.Last, make sure you recognize what harms your credit report.

As an example, obtaining a lot of bank card at the same time decreases your score.You don't intend to do anything to hurt your score in the months before you make an application for a financing.

lenty of Cash money If you intend to turn a house, you require cash.New capitalists get into financial trouble when they purchase a residence without a sizable deposit, then make use of charge card to pay for residence enhancements and renovations.If your house doesn't offer quickly, or if remodellings cost greater than anticipated, all of a sudden the financier remains in way over their head.

If you intend to flip efficiently, you need plenty of cash on hand. The majority of standard lenders require a deposit of 25%, and also traditional lending institutions are where you'll obtain the very best price.

When you have the money to cover a deposit, you do not have to pay private home mortgage insurance, or PMI.5% and 5% of the lending, so needing to pay this monthly can really reduce into your profits.According to TIME, a lot of capitalists secure an interest-only funding, and the typical rate of interest for this kind of finance is 12% to 14%. In contrast, the interest rate for a traditional home loan is generally 4%. The more you can pay in money, the less rate of interest you'll incur.

There are several means to build cash in your interest-bearing account. Make use of an automatic financial savings plan to make conserving cash monthly effortless.Or find ways to earn extra money on the side and then use this loan to develop your cash money gets for an investment.If you're acquiring a foreclosure from a financial institution or with a property public auction, an additional option is to get a residence equity credit line (HELOC), if you qualify.If you have enough in cost savings as well as handle to find a bargain-priced residence, you can acquire the residence and afterwards take out a little loan or credit line to pay for the renovations and also various other costs.

Even if a residence is costing a rock-bottom cost doesn't imply you can put cash in it as well as automatically make a fortune.Successful flippers are very discerning regarding the residences they select to invest in.

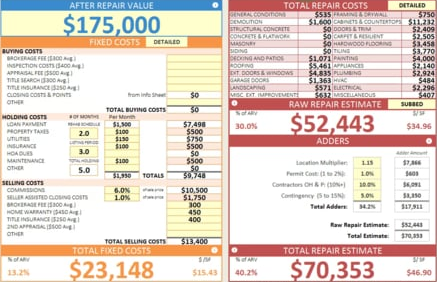

Here's an example: If a home’s ARV is $150,000 and it needs $25,000 in repairs, then the 70% rule means that an investor should pay no more than $80,000 for the home. $150,000 x 0. Lastly, you want to buy your property in a neighbourhood that can support higher prices. Too many people buy properties and renovate them in areas that will have difficulty in supporting the premium price they’re trying to sell at. It’s a critical mistake.

Right here are Some More Info on Flipping Houses In Houston

Right here are Some More Information on Flipping Houses In Houston

Once you own the house, you'll need to invest time to fix it up. Not Enough Time Renovating and flipping houses is a time-consuming business venture. Next, research the safety of each neighborhood you’re considering. Don’t invest in a house too far away from where you live or work; you’ll spend more money on gas and it will take longer to fix up. So I asked her if flipping houses was as easy as it looked on TV. Put simply, don't pay too much for a home (by knowing what it's worth) and make sure you also know how much the necessary repairs or upgrades will cost before you buy.

Below are Some More Info on Flipping Houses In Houston

Second, you always want access to money. A good friend of ours did a multi-million dollar flip recently, and the construction loan wasn’t enough to complete the job, but he had access to “private money” where he could borrow what he needed really quickly. Make sure you have access to more money than you need or you can easily become the “motivated seller” you were initially looking for. If you still want to flip a house, you should approach the venture just as you would any new business. Having that information, you can then figure an ideal purchase price. Accordingly, the odds of making a profit on your investment will be dramatically reduced.

Right here are Some More Info on Flipping Houses In Houston

When considering an investment home’s location, you also need to think about its proximity to your primary residence. According to TIME, most investors take out an interest-only loan, and the average interest rate for this type of loan is 12% to 14%. The real money in house flipping comes from sweat equity. Great Credit You can’t get into house flipping with lousy credit, end of story. 4 Answers · Business & Finance · 16/11/2013 I want to get into the real estate business and flip houses. how do I get started without any money? For many flippers, flipping is a full-time job, and they will likely know about this house too. Services like Angie’s List, Porch, and HomeAdvisor can help you find reliable professionals in your area. If memory serves me properly, this property needed basement foundation repairs, a full kitchen renovation, a new basement interior, two new bathrooms, new floors and landscaping. Start building a network of contractors you trust, including plumbers, electricians, and landscapers.

<<< Next

See Here More

Union Investment Real Estate Why Is Real Estate Considered An Investment

Union Investment Real Estate Breakthrough Real Estate Investing Podcast

Long Distance Real Estate Investing Pdf Falcon Real Estate Investment Company