Self Directed Ira Real Estate Investment Washington Real Estate Investment Trust Stock

home

You found the best source for complete information and resources for Flip Or Flop Houses That Didn T Sell online.

Unless you have adequate money to pay for a home and all necessary restorations, you'll need some type of loan.And loaning standards are tighter than they made use of to be, specifically if you desire a lending for a risky home flip.Your primary step is to check your credit history report to figure out your score.Federal legislation permits you a complimentary credit rating record from each of the three nationwide credit history reporting companies every one year, so this will not cost you anything.

You can obtain your free credit report from AnnualCreditReport.com or by calling 1-877-322-8228. If you do not have great credit, it's time to begin developing an excellent credit score now.Pay your costs in a timely manner, pay for your financial obligation, and also keep your credit card balances reduced.

There are a lot of various other means to improve your credit score, so take the time to do every little thing you can.

The greater your credit score, the much better rates of interest you'll jump on a home mortgage.

This can conserve you thousands when you begin residence turning, freeing up more of your money to buy your home itself.Last, make sure you know what injures your credit score.

As an example, getting a lot of credit cards at once reduces your score.You do not want to do anything to harm your rating in the months prior to you look for a financing.

lenty of Cash If you intend to flip a residence, you need cash.New capitalists get involved in monetary difficulty when they buy a residence without a substantial down payment, after that use credit cards to spend for house renovations and also renovations.If your home does not sell promptly, or if improvements cost greater than expected, unexpectedly the capitalist remains in way over their head.

If you intend to turn successfully, you need a lot of cash money handy. A lot of standard loan providers need a deposit of 25%, and also conventional lending institutions are where you'll get the very best price.

When you have the cash money to cover a down payment, you do not have to pay exclusive home loan insurance coverage, or PMI.5% as well as 5% of the funding, so having to pay this monthly can actually cut right into your profits.According to TIME, a lot of investors obtain an interest-only finance, and also the average rate of interest for this type of lending is 12% to 14%. In comparison, the interest rate for a traditional home loan is usually 4%. The more you can pay in cash, the less rate of interest you'll sustain.

There are several means to develop money in your savings account. Use an automated cost savings prepare to make conserving cash each month effortless.Or locate ways to earn extra money on the side and after that use this loan to develop your cash money reserves for an investment.If you're buying a foreclosure from a bank or with a realty auction, another option is to get a home equity line of credit (HELOC), if you qualify.If you have enough in cost savings as well as take care of to discover a bargain-priced home, you can buy the house and afterwards take out a tiny financing or line of credit to pay for the renovations and various other costs.

Even if a residence is costing a rock-bottom price does not indicate you can put cash in it as well as immediately make a fortune.Successful flippers are extremely discerning concerning the residences they select to purchase.

If you make smart decisions, you can make a lot of money flipping. Inc. (formerly known as Kohlberg Kravis Roberts &Co. and KKR & Co.

Below are Some Even more Info on Flip Or Flop Houses That Didn T Sell

More Information Around Flip Or Flop Houses That Didn T Sell

ATTOM Data Solutions reports that more than 200,000 in the United States were bought and the resold with the same 12-month period in 2017. In a neighborhood of $100,000 homes, do you really expect to buy at $60,000 and sell at $200,000?

Much more Resources For Flip Or Flop Houses That Didn T Sell Here are Some More Resources on Flip Or Flop Houses That Didn T Sell

What kind of house do people want to buy right now? In general, your focus should be on speed as opposed to maximum profit. This means you can get the house up for sale faster and make fewer mortgage payments. Not Enough Money Dabbling in real estate is an expensive proposition. At any given time there are half-a-dozen shows on television where good-looking, well-dressed investors make the process look fast, fun and profitable.

Right here are Some Even more Details on Flip Or Flop Houses That Didn T Sell

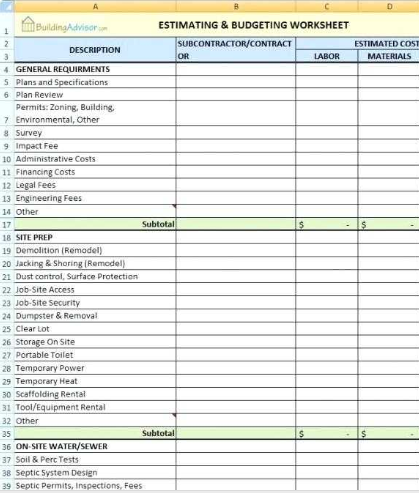

The lessons from this experience have ended up being worth much more than that $3,000 in profit. Understand Your Finance Options Next, become an expert on home financing options. Don’t invest in a house too far away from where you live or work; you’ll spend more money on gas and it will take longer to fix up. Find a Mentor If you know a successful house flipper, ask if they’d be willing to mentor you. Once the work is done, you'll need to schedule inspections to make sure the property complies with applicable building codes before you can sell it. If memory serves me properly, this property needed basement foundation repairs, a full kitchen renovation, a new basement interior, two new bathrooms, new floors and landscaping. Hiring a GC can be expensive; they’ll add 10% to 20% onto what their subcontractors charge when calculating your final bill. A $25,000 kitchen, a $10,000 bathroom, $5,000 in real estate taxes, utilities and other carrying costs cuts that number by around two-thirds.

Last >>>

More From This Category

Union Investment Real Estate Investing In Real Estate With Self Directed Ira

Self Directed Ira Real Estate Investment Investing In Real Estate In Jamaica

Union Investment Real Estate What Is Real Estate Investing 101