Union Investment Real Estate Best Real Estate Investment In Hyderabad 2016

home

We have the best source for complete info and resources for Flip Flop House Shoes online.

Unless you have enough cash money to spend for a home and also all essential remodellings, you'll require some kind of loan.And borrowing requirements are tighter than they made use of to be, particularly if you want a loan for a high-risk home flip.Your initial step is to inspect your credit rating report to discover your score.Federal regulation permits you a cost-free debt report from each of the 3 nationwide credit score reporting business every year, so this won't cost you anything.

You can obtain your cost-free credit history report from AnnualCreditReport.com or by calling 1-877-322-8228. If you do not have fantastic credit score, it's time to start building an excellent credit history now.Pay your bills on schedule, pay for your financial obligation, as well as maintain your credit card equilibriums reduced.

There are lots of various other ways to improve your credit history, so take the time to do whatever you can.

The higher your credit score, the far better rate of interest you'll jump on a mortgage.

This can conserve you thousands when you start house flipping, maximizing even more of your cash to purchase the house itself.Last, make certain you understand what hurts your credit score.

For instance, getting a lot of charge card at the same time reduces your score.You don't want to do anything to injure your rating in the months prior to you look for a car loan.

lenty of Money If you want to turn a residence, you need cash.New capitalists get into economic difficulty when they acquire a residence without a substantial deposit, then use bank card to pay for residence enhancements and renovations.If your house doesn't offer promptly, or if renovations cost more than expected, all of a sudden the financier remains in way over their head.

If you intend to flip effectively, you require lots of cash money accessible. A lot of conventional loan providers require a down payment of 25%, and also standard lending institutions are where you'll get the most effective rate.

When you have the money to cover a deposit, you do not need to pay private home loan insurance, or PMI.5% and 5% of the financing, so having to pay this each month can actually reduce right into your profits.According to TIME, the majority of capitalists get an interest-only finance, as well as the typical interest rate for this kind of finance is 12% to 14%. In contrast, the rate of interest for a traditional home mortgage is typically 4%. The even more you can pay in money, the less passion you'll incur.

There are several ways to develop money in your savings account. Utilize an automatic financial savings plan to make conserving cash every month effortless.Or locate ways to earn extra money on the side and afterwards utilize this money to construct your cash money books for an investment.If you're getting a repossession from a financial institution or through a real estate auction, one more alternative is to obtain a house equity line of credit (HELOC), if you qualify.If you have sufficient in financial savings and also manage to discover a bargain-priced residence, you can purchase the house and afterwards take out a tiny finance or line of credit to pay for the remodellings and various other expenses.

Even if a residence is costing a rock-bottom cost doesn't imply you can place loan in it and also immediately make a fortune.Successful fins are very critical concerning the residences they choose to purchase.

The worst house in a great neighborhood has nowhere to go but up in value, due to the value of the other homes in the area. Your first step is to check your credit report to find out your score. 7 Answers · Business & Finance · 22/06/2006 How do you get into real estate (flipping houses)? ...to pay cash, hard to get a mortgage on a cheap house. Having that information, you can then figure an ideal purchase price. You also need to understand the applicable tax laws and zoning laws, and know when to cut your losses and get out before your project becomes a money pit. Learn How Much Average Projects Cost Do you know how much it costs to recarpet a 1,000-square-foot home?

More Information Around Flip Flop House Shoes

More Resources For Flip Flop House Shoes Below are Some Even more Resources on Flip Flop House Shoes

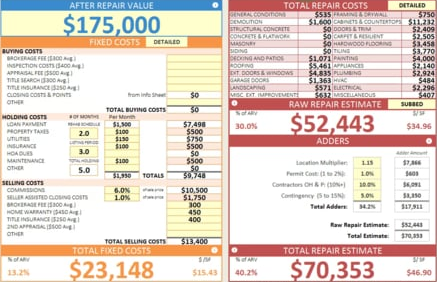

Focus on homes that only need some quick updates to resell. Refinishing kitchen cabinets, adding new hardware, fixing up the yard, and updating paint and carpeting are all relatively inexpensive projects that can transform a home. Here's an example: If a home’s ARV is $150,000 and it needs $25,000 in repairs, then the 70% rule means that an investor should pay no more than $80,000 for the home. $150,000 x 0. Make an Offer Once you find a home you like, it’s time to make an offer. You now have to pay for your own rent or mortgage, plus the mortgage for your flip property, as well as utilities, home insurance, and property taxes. P.) joining other private investment firms seeking a piece of the action.

Here are Some Even more Info on Flip Flop House Shoes

When flipping houses for profit in Canada you should keep these specifics in mind: First, you need to have a contractor you can trust, and regardless of their experience and track record, you’ll ultimately need to be the project manager if you want things to work on your timelines. The 70% rule states that an investor should pay no more than 70% of the ARV (after-repair value) of a property minus the repairs needed. The ARV is what a home is worth after it is fully repaired.

Even more Details About Flip Flop House Shoes

The 70% rule states that an investor should pay no more than 70% of the ARV (after-repair value) of a property minus the repairs needed. The ARV is what a home is worth after it is fully repaired. You’ll save money in realtor fees, but in some markets, you might end up waiting a long time for the house to sell. At any given time there are half-a-dozen shows on television where good-looking, well-dressed investors make the process look fast, fun and profitable. There are several ways to build cash in your savings account. Use an automatic savings plan to make saving money each month effortless. Understanding market absorption metrics has been critical to our own success, and we hold classes in our offices teaching clients how to do this. It’s like having the ability to peak into the future. In a stable or declining market you can lose money even if you do things right. Put simply, don't pay too much for a home (by knowing what it's worth) and make sure you also know how much the necessary repairs or upgrades will cost before you buy.

Last Article Next

More Info

Union Investment Real Estate Blackrock Real Estate Investments

Union Investment Real Estate Geskaria Real Estate Investments

Union Investment Real Estate Investing In Real Estate In China