Union Investment Real Estate Drake Real Estate Investments

index

You found the complete source for total info and resources for House Flip Game Tips on the web.

Unless you have enough cash money to spend for a residence as well as all essential improvements, you'll require some sort of loan.And loaning criteria are tighter than they used to be, especially if you want a financing for a risky residence flip.Your very first step is to inspect your credit history report to discover your score.Federal law allows you a cost-free credit record from each of the three national credit reporting firms every one year, so this won't cost you anything.

You can obtain your complimentary credit rating report from AnnualCreditReport.com or by calling 1-877-322-8228. If you don't have great credit report, it's time to start building a great credit report now.Pay your bills in a timely manner, pay down your financial obligation, and keep your bank card equilibriums low.

There are plenty of other ways to improve your credit report, so put in the time to do whatever you can.

The greater your credit score, the far better rate of interest you'll hop on a home loan.

This can conserve you thousands when you start home flipping, maximizing more of your money to invest in your home itself.Last, make certain you know what injures your credit score.

As an example, taking out too many charge card at once lowers your score.You don't wish to do anything to harm your rating in the months prior to you get a financing.

lenty of Money If you wish to flip a residence, you require cash.New financiers get involved in financial difficulty when they get a residence without a large deposit, then utilize credit cards to spend for home improvements and also renovations.If the house does not sell rapidly, or if improvements cost greater than anticipated, unexpectedly the financier remains in means over their head.

If you want to flip effectively, you require lots of cash money accessible. Most conventional lenders call for a down payment of 25%, and conventional lenders are where you'll obtain the most effective price.

When you have the money to cover a deposit, you don't have to pay exclusive home loan insurance coverage, or PMI.5% as well as 5% of the lending, so having to pay this monthly can really reduce into your profits.According to TIME, many investors get an interest-only funding, and the typical interest rate for this kind of car loan is 12% to 14%. In contrast, the rates of interest for a conventional home mortgage is normally 4%. The even more you can pay in cash money, the much less passion you'll sustain.

There are a number of methods to build money in your interest-bearing account. Make use of an automated financial savings prepare to make conserving money monthly effortless.Or locate ways to earn additional money on the side and then use this money to construct your cash money gets for an investment.If you're acquiring a repossession from a financial institution or via a realty public auction, an additional option is to take out a home equity line of credit (HELOC), if you qualify.If you have enough in savings and take care of to find a bargain-priced residence, you can get the house and then get a small finance or line of credit to pay for the restorations and also other prices.

Even if a home is costing a rock-bottom price doesn't indicate you can put cash in it and also automatically make a fortune.Successful flippers are very critical regarding the homes they choose to buy.

It can take months to find and buy the right property. Or it may mean creating a killer media centre in the basement for movies and entertaining. On the other hand, if you don’t know a Phillips-head screwdriver from a flat screwdriver, you will need to pay a professional to do all of the renovations and repairs. For example, ask if they’ll mentor you in exchange for a small percentage of your first successful flip. Do whatever you can to build relationships with future buyers.

Here are Some More Information on House Flip Game Tips

Right here are Some More Information on House Flip Game Tips

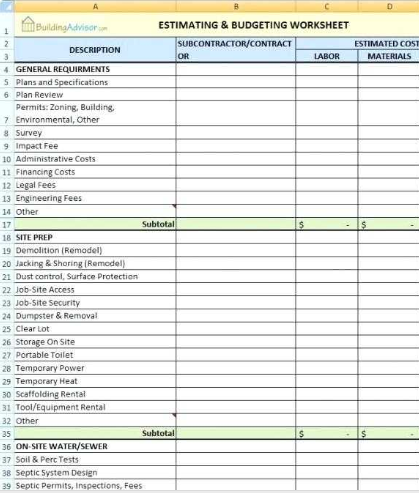

Professionals either do the work themselves or rely on a network of pre-arranged, reliable contractors. Hiring a GC can be expensive; they’ll add 10% to 20% onto what their subcontractors charge when calculating your final bill. Try to buy the worst house in a great neighborhood, versus the best house in a lousy neighborhood. According to RealtyTrac senior vice president Daren Blomquist, 20% is the minimum profit you need to at least account for remodeling and other carrying costs. For many people, it might make more sense to stick with a day job, where they can earn the same kind of money in a few weeks or months via a steady paycheck – with no risk and a very consistent time commitment.

Right here are Some More Info on House Flip Game Tips

You see, Nick, flipped his first home when he was 21 years old. He spent months on this little 2-bedroom property in Mississauga near Cawthra Road and Lakeshore Road behind Cawthra Park High School. For many people, it might make more sense to stick with a day job, where they can earn the same kind of money in a few weeks or months via a steady paycheck – with no risk and a very consistent time commitment. I would personally suggest a...of studying & getting all your ... Here's an example: If a home’s ARV is $150,000 and it needs $25,000 in repairs, then the 70% rule means that an investor should pay no more than $80,000 for the home. $150,000 x 0. You don’t want to do anything to hurt your score in the months before you apply for a loan.

More Details Around House Flip Game Tips

Of course, paying cash for the property eliminates the cost of interest, but even then there are property holding costs and opportunity costs for tying up your cash. And lending standards are tighter than they used to be, especially if you want a loan for a high-risk house flip. You now have to pay for your own rent or mortgage, plus the mortgage for your flip property, as well as utilities, home insurance, and property taxes. According to CNBC, house flipping is the most popular it’s been in a decade, yet the average return for flippers is lower than in previous years. This way the mentor is motivated to tutor you, and you’ll be sure to get a high-quality education. You might even want to consider offering this person an incentive to be your mentor. Last, when considering a home, don’t forget to factor in the cost of building permits. Another way to find foreclosures is through a bank. From hiring reliable contractors to running financial estimates, you can eliminate most of the risk from your first fix and flip with just a little reading and effort.

Last Article Next Post

More From This Category

Union Investment Real Estate The Ultimate Beginners Guide To Real Estate Investing Audiobook

Union Investment Real Estate Foreign Investment In Real Estate Property Tax Act Firpta

Union Investment Real Estate Forming A Real Estate Investment Group