Union Investment Real Estate First Union Real Estate Investments

index

You found the top source for total info and resources for How To Flip Houses With No Money on the Internet.

Unless you have enough cash money to pay for a residence and all necessary remodellings, you'll need some kind of loan.And borrowing criteria are tighter than they utilized to be, especially if you want a funding for a high-risk house flip.Your initial step is to examine your credit history record to find out your score.Federal regulation enables you a totally free credit score report from each of the 3 national credit scores reporting business every 12 months, so this won't cost you anything.

You can obtain your cost-free credit history report from AnnualCreditReport.com or by calling 1-877-322-8228. If you do not have terrific credit score, it's time to begin developing a good credit score now.Pay your expenses on schedule, pay down your debt, and also maintain your charge card balances low.

There are plenty of various other ways to improve your credit report, so take the time to do every little thing you can.

The greater your credit history, the much better interest rate you'll jump on a mortgage.

This can save you thousands when you begin home flipping, freeing up even more of your money to buy your house itself.Last, make sure you know what hurts your credit rating.

As an example, obtaining way too many charge card at once lowers your score.You do not wish to do anything to injure your rating in the months prior to you look for a car loan.

lenty of Money If you wish to flip a home, you need cash.New investors get into financial difficulty when they acquire a home without a sizable deposit, then make use of credit cards to spend for residence improvements as well as renovations.If your house doesn't offer quickly, or if improvements set you back greater than expected, instantly the capitalist remains in way over their head.

If you want to flip effectively, you require plenty of money available. A lot of traditional lenders require a down payment of 25%, and standard lending institutions are where you'll get the most effective price.

When you have the money to cover a down payment, you do not have to pay exclusive mortgage insurance coverage, or PMI.5% and 5% of the car loan, so needing to pay this monthly can really cut right into your profits.According to TIME, many financiers obtain an interest-only finance, and the typical interest rate for this type of loan is 12% to 14%. In contrast, the rate of interest for a standard home mortgage is normally 4%. The even more you can pay in money, the much less rate of interest you'll sustain.

There are numerous means to develop money in your savings account. Utilize an automated cost savings intend to make conserving loan every month effortless.Or find means to gain extra money on the side and afterwards utilize this money to construct your cash money reserves for an investment.If you're acquiring a repossession from a financial institution or with a realty public auction, one more option is to get a residence equity line of credit (HELOC), if you qualify.If you have enough in cost savings and also take care of to find a bargain-priced residence, you can purchase the home and then get a small finance or line of credit to pay for the remodellings and also other costs.

Just because a residence is costing a rock-bottom cost doesn't indicate you can place cash in it as well as automatically make a fortune.Successful flippers are extremely discerning regarding the homes they select to purchase.

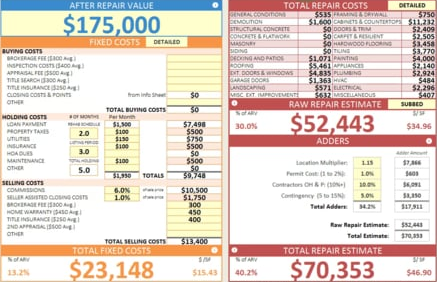

Once the work is done, you'll need to schedule inspections to make sure the property complies with applicable building codes before you can sell it. The average gross profit on a flip is $65,520, but that’s gross. You might also have to pay for home staging and realtor fees when the house finally sells. Investors who flip properties concentrate on the purchase and subsequent resale of one property, or a group of properties. Inc. (formerly known as Kohlberg Kravis Roberts &Co. and KKR & Co. Under search filters, select the option for “foreclosures.” Your local newspaper is another source of foreclosure listings.

Right here are Some More Information on How To Flip Houses With No Money

Even more Info About How To Flip Houses With No Money

4 Answers · Business & Finance · 16/11/2013 I want to get into the real estate business and flip houses. how do I get started without any money? Keep in mind that an online photo gallery only tells part of the story. The company expects to buy and flip properties within 90 days, and they’ve got the data and knowledge to offer mom-and-pop operators some fierce competition.

More Details About How To Flip Houses With No Money

Not Enough Knowledge To be successful, you need to be able to pick the right property, in the right location, at the right price. Understanding market absorption metrics has been critical to our own success, and we hold classes in our offices teaching clients how to do this. It’s like having the ability to peak into the future.

More Info Around How To Flip Houses With No Money

You see, Nick, flipped his first home when he was 21 years old. He spent months on this little 2-bedroom property in Mississauga near Cawthra Road and Lakeshore Road behind Cawthra Park High School. Next, we’ve found that people pay more money for a property when you sell a “lifestyle” instead of 3-bedrooms and 2-full bathrooms. For example, adding in a “steam option” to the shower is a huge plus. Creating a “fitness centre” instead of a typical “gym” in the home is a huge plus. This may mean connecting a bathroom with a steam room to the gym and having a dry sauna as well. Good negotiation strategies will help you effectively haggle with contractors and other workers. You also need to understand the applicable tax laws and zoning laws, and know when to cut your losses and get out before your project becomes a money pit. It will likely wind up being harder and more expensive than you ever imagined. And we’ve both gone on to do other flips and invest in other properties. When you estimate the cost of any job, experts advise adding 20% to the final total as it will always cost more than you think it will. You can review extensive details about the home’s history, including repairs, remodeling, and additions.

Previous Next Article

More From This Category

Long Distance Real Estate Investing Pdf Ny Real Estate Investing Group

Long Distance Real Estate Investing Pdf Axa Real Estate Investment Managers Luxembourg

Long Distance Real Estate Investing Pdf Good Cap Rate For Real Estate Investment