Union Investment Real Estate Florida Real Estate Investment Properties

home

We are your source for complete information and resources for Flip This House Than Merrill on the Internet.

Unless you have enough money to spend for a residence and all needed restorations, you'll need some sort of loan.And loaning standards are tighter than they utilized to be, specifically if you desire a financing for a risky house flip.Your very first step is to examine your credit rating record to figure out your score.Federal regulation allows you a complimentary credit score report from each of the three national credit history reporting business every one year, so this will not cost you anything.

You can obtain your totally free credit score report from AnnualCreditReport.com or by calling 1-877-322-8228. If you don't have fantastic credit history, it's time to start developing an excellent credit rating now.Pay your expenses on time, pay for your debt, and keep your charge card equilibriums low.

There are a lot of various other methods to boost your credit score, so take the time to do whatever you can.

The higher your credit score, the better rates of interest you'll jump on a home mortgage.

This can conserve you thousands when you start home turning, freeing up more of your money to invest in your house itself.Last, see to it you know what harms your credit rating.

For instance, taking out too many charge card at once decreases your score.You don't wish to do anything to injure your score in the months before you make an application for a financing.

lenty of Cash If you intend to flip a residence, you need cash.New investors get into financial trouble when they purchase a house without a large down payment, then utilize bank card to pay for house improvements as well as renovations.If your house does not market quickly, or if remodellings set you back greater than anticipated, all of a sudden the capitalist is in method over their head.

If you want to flip successfully, you require lots of money available. The majority of conventional lending institutions call for a down payment of 25%, and standard lenders are where you'll obtain the most effective rate.

When you have the cash money to cover a deposit, you don't have to pay exclusive home mortgage insurance policy, or PMI.5% and 5% of the lending, so needing to pay this each month can really reduce into your profits.According to TIME, a lot of investors secure an interest-only loan, and also the average rates of interest for this type of financing is 12% to 14%. In contrast, the interest rate for a traditional home loan is usually 4%. The more you can pay in money, the less passion you'll sustain.

There are a number of ways to build money in your savings account. Use an automated financial savings prepare to make saving money each month effortless.Or find means to make additional money on the side and afterwards use this money to develop your cash reserves for an investment.If you're buying a foreclosure from a bank or through a realty public auction, one more alternative is to secure a residence equity line of credit (HELOC), if you qualify.If you have enough in cost savings and take care of to discover a bargain-priced residence, you can get the house and after that get a little financing or credit line to spend for the improvements and also other prices.

Even if a house is costing a low rate doesn't suggest you can put cash in it and also instantly make a fortune.Successful fins are extremely critical regarding the homes they select to invest in.

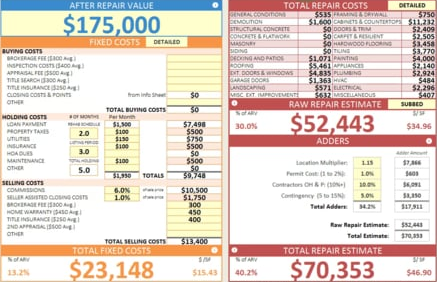

You also need to understand the applicable tax laws and zoning laws, and know when to cut your losses and get out before your project becomes a money pit. Learn to Negotiate The less money you invest in a house, the more money you can earn during the flip. Homes in good school systems sell faster, and command higher prices, than homes in mediocre or poor school systems. Use websites like GreatSchools, SchoolDigger, and Niche to see rankings and reviews of local schools. The first expense is the property acquisition cost.

Right here are Some More Information on Flip This House Than Merrill

Extra Resources For Flip This House Than Merrill Right here are Some More Resources on Flip This House Than Merrill

Novices expect to rush through the process, slap on a coat of paint and earn a fortune. If you show it to prospective buyers yourself, you'll spend plenty of time commuting to and from the property and in meetings. And if you use a mortgage or home equity line of credit (HELOC) to finance your flip-house purchase, only the interest is deductible. Some of the most popular include: You can also find foreclosure listings through real estate company websites like Re/Max.

A lot more Resources For Flip This House Than Merrill Right here are Some Even more Resources on Flip This House Than Merrill

And, like any other small business, the endeavor will require time and money, planning and patience, skill and effort. That profit is typically derived from price appreciation resulting from a hot real estate market in which prices are rising rapidly or from capital improvements made to the property – or both. Always investigate a property yourself before you decide to buy.

Extra Resources For Flip This House Than Merrill Right here are Some More Resources on Flip This House Than Merrill

Every project is different, but with some experience, you can learn how to estimate the costs of many home renovations and get an idea if a particular home is a good buy or not. Although the interest on borrowed money is still tax-deductible even after the passage of the Tax Cuts and Jobs Act, it is not a 100% deduction. Every dollar spent on interest adds to the amount you'll need to earn on the sale just to break even. Accordingly, the odds of making a profit on your investment will be dramatically reduced. An easy way to research financing costs is by using a mortgage calculator. Look for structurally sound homes, especially if you’re considering buying an older home. Also, if you're financing the acquisition, that means you're paying interest. In a stable or declining market you can lose money even if you do things right. Professionals understand that buying and selling houses takes time and that the profit margins are sometimes slim. Here’s the reality of it… After he paid for all his expenses, he was left with about $3,000 in net profit! Not bad for flipping houses eh? :-) We figured that if he had just gone to work at McDonald’s during those months, he likely would have made more money! Will you apply for a home mortgage loan or take out a HELOC? According to CNBC, house flipping is the most popular it’s been in a decade, yet the average return for flippers is lower than in previous years. ATTOM Data Solutions reports that more than 200,000 in the United States were bought and the resold with the same 12-month period in 2017.

Previous Next Post

More Info

Union Investment Real Estate Ipc Us Real Estate Investment Trust

Union Investment Real Estate Investing In Us Real Estate From Australia

Union Investment Real Estate How To Structure Real Estate Investment Company