Union Investment Real Estate Real Estate Finance And Investment Center

home

We are your source for total information and resources for Before And After House Flips on the web.

Unless you have sufficient cash to pay for a residence as well as all essential renovations, you'll need some sort of loan.And borrowing standards are tighter than they made use of to be, particularly if you desire a car loan for a high-risk home flip.Your very first step is to examine your credit score record to find out your score.Federal law allows you a complimentary credit report from each of the 3 national credit history reporting firms every twelve month, so this will not cost you anything.

You can obtain your totally free credit history report from AnnualCreditReport.com or by calling 1-877-322-8228. If you don't have excellent credit rating, it's time to begin constructing an excellent credit report now.Pay your expenses promptly, pay down your debt, and also keep your charge card equilibriums low.

There are lots of various other means to improve your credit history, so take the time to do whatever you can.

The greater your credit rating, the much better rates of interest you'll get on a home mortgage.

This can conserve you thousands when you begin residence flipping, maximizing more of your loan to invest in the house itself.Last, see to it you understand what injures your credit rating.

For instance, getting a lot of credit cards at once decreases your score.You don't intend to do anything to injure your rating in the months before you obtain a loan.

lenty of Money If you intend to flip a house, you require cash.New financiers get involved in monetary difficulty when they purchase a residence without a large deposit, after that make use of charge card to spend for house enhancements and renovations.If your home doesn't market swiftly, or if restorations cost more than anticipated, instantly the capitalist remains in method over their head.

If you wish to flip effectively, you need lots of cash on hand. A lot of traditional loan providers require a down payment of 25%, and also standard loan providers are where you'll obtain the best price.

When you have the money to cover a deposit, you don't need to pay personal home mortgage insurance coverage, or PMI.5% and also 5% of the car loan, so needing to pay this each month can really cut right into your profits.According to TIME, most investors get an interest-only car loan, and also the ordinary rate of interest for this sort of loan is 12% to 14%. In contrast, the interest rate for a standard home loan is commonly 4%. The even more you can pay in cash, the much less passion you'll sustain.

There are several methods to develop cash in your interest-bearing account. Make use of an automatic financial savings plan to make saving money each month effortless.Or discover ways to gain money on the side and afterwards utilize this money to construct your cash books for an investment.If you're buying a repossession from a bank or with a realty public auction, another option is to secure a home equity credit line (HELOC), if you qualify.If you have sufficient in savings as well as handle to find a bargain-priced home, you can purchase the house and after that secure a small finance or credit line to pay for the remodellings as well as various other costs.

Even if a residence is selling for a rock-bottom cost does not suggest you can place cash in it as well as instantly make a fortune.Successful flippers are really critical concerning the houses they choose to buy.

Keep in mind that Zillow, the real estate listing firm, is now flipping homes in select markets. Start by researching local cities and neighborhoods.

Even more Info About Before And After House Flips

Below are Some More Info on Before And After House Flips

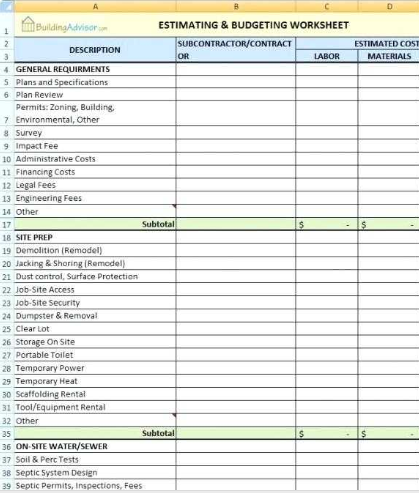

An easy way to research financing costs is by using a mortgage calculator. If you’re flipping a house while working a full-time job, hiring a GC is probably a necessity; someone has to be available at the house to oversee the work at least part-time, or the project will never get done. If you put too much into the home, you won’t make your money back. Investors who flip properties concentrate on the purchase and subsequent resale of one property, or a group of properties. In a stable or declining market you can lose money even if you do things right. Investors who flip properties concentrate on the purchase and subsequent resale of one property, or a group of properties.

Much more Resources For Before And After House Flips Below are Some Even more Resources on Before And After House Flips

House flipping is when real estate investors buy homes, usually at auction, and then resell them at a profit months down the road. This can save you thousands when you start house flipping, freeing up more of your money to invest in the house itself. But you can also lose everything you own if you make a bad decision.

Even more Info About Before And After House Flips

Books like “The Flipping Blueprint: The Complete Plan for Flipping Houses and Creating Your Real Estate-Investing Business” by Luke Weber can tell you everything you need to know to get started and avoid some rookie mistakes.Buy a house, make a few cosmetic fixes, put it back on the market and make a huge profit. The higher your credit score, the better interest rate you’ll get on a home loan. However, the investors making this much money really know what they’re doing — and even they still go bust sometimes. If you're handy with a hammer, enjoy laying carpet, can hang drywall, roof a house and install a kitchen sink, you've got the skills to flip a house. Doing it yourself might save you money upfront, but if it takes you three times longer than a professional, it might not be worth it. Contractors who are habitually late will waste your time and slow up your renovation project. They have the knowledge, skills and experience to find and fix a house. Keep in mind that Zillow, the real estate listing firm, is now flipping homes in select markets. And if you use a mortgage or home equity line of credit (HELOC) to finance your flip-house purchase, only the interest is deductible. This can save you a significant amount of money – if you know what you’re doing.

Last Article Next one

See Here More

Union Investment Real Estate Why Invest In Real Estate 2017

Union Investment Real Estate Donald Trump Real Estate Investing Book

Union Investment Real Estate Chennai Real Estate Investment Advice